I’m often asked on financial documents whether I own any investment properties. I hesitate slightly as I always want to include my own home.

When purchasing a home, my first concern is buying something that I like but secondly the potential for growth or value improvement or both. I don’t go in with the intention of selling after a certain period of time but I do consider any equity I accrue as money that I can use for my retirement or for other investments.

I apply a different perspective when buying a car but still with the view of not wasting my money. Other than specialised vehicles, cars depreciate as soon as you buy them. Additionally, the running costs, registration and insurance really add up every year. They really are a poor investment. I would prefer to have a car that is affordable and reliable rather than a status seeking item. There have been periods where I have not had a car at all when I had public transport on my doorstep.

Investment is not limited to financially matters but also for personal development. As I blogged previously in Motivational and inspirational podcasts, I prefer to utilise my driving time to listen to financial and business podcasts that add value to my day. Sadly,,,pathetically maybe…the only music I enjoy is dancy pop music. For a guy in his early 50’s, pulling up at the lights blasting the latest Bieber is a little awkward.

I love TV but rarely get into serial shows or sitcoms. I enjoyed the first season of Game of Thrones and the Walking Dead but I quickly got bored. However, I could watch countless reality programs on real estate, home improvement, DIY and cooking. To me, while still being entertaining, they are educational and an investment in my knowledge. I might learn something that I can used to make money or a new hobby. Watching endless hours of sports and standard TV programming takes up time and is fun but not particularly beneficial.

Admittedly, my investment mindset is only a recent thing. Over the years, I have no doubt thrown away tens of thousands of dollars through poor purchases and excessive entertainment (i.e. partying). For sure, I have accumulated some great memories but there is no question that had I started to invest in value adding purchases and personal development from an early age, I would be in a very desirable position now. I could still have had some awesome nights out and travelled but I could reduce them easy by 50% and still be doing well.

While reality TV programming and podcasts and relatively new, I could have spent a lot more time reading. Though I prefer non-fiction business and self-development books, even fiction has value as an investment in your education. My English language was (is still?) appalling when I left school. I didn’t enjoy formal education and I still have little understanding of nouns, pronouns, verbs and punctuation. However, through reading I have developed a fair appreciation of sentence structure and how to write. I will note that other than forced reading at school, I didn’t read a book until I was in my 30’s. Over a decade that I could have utilised to invest in learning.

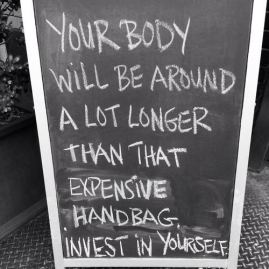

Another aspect of investment is in your health. I was fortunate to find a love of working  out and eating healthy at an early age. Unfortunately, I also found a love for drinking. I’m thankful I found the first as it balanced the drinking to a degree. In saying that, I have some health issues now that perhaps I could have avoided with a healthier lifestyle. Others have overindulged their whole life. Like financial investment, it’s a lot harder to start at a later age and get results. Start early with a healthy lifestyle for immediate and longer-term benefits.

out and eating healthy at an early age. Unfortunately, I also found a love for drinking. I’m thankful I found the first as it balanced the drinking to a degree. In saying that, I have some health issues now that perhaps I could have avoided with a healthier lifestyle. Others have overindulged their whole life. Like financial investment, it’s a lot harder to start at a later age and get results. Start early with a healthy lifestyle for immediate and longer-term benefits.

My first property purchase wasn’t until the age of 40. Again, a very late starter. I have probably paid off a full mortgage in rental payments. If I had some foresight and put a little money into buying even a small unit or block of land and continued to invest money made, I would be on easy street now rather than fighting to find a way to an early retirement.

The point of my blog is not to illustrate my appalling earlier life choices but rather to show that there are opportunities to invest all around. I wish I could have realised it earlier in my life but there is no point looking back with regret. As my favourite saying goes ‘The best time to plant a tree is 20 years ago, the second best time is now’. Whatever your age and whatever your situation, it’s always the right time to start investing.

solicitor advising that the vendor was requesting an extension. The reason being that the owner was still looking for a property to rent. As I had been informed that the property was occupied by a renter and the owner was an investor, I saw no reason why the owner needed an extension for that reason. From my experience, it is usually the buyer that is seeking an extension to finalise finances.

postponing potential open home viewings for prospective tenants.

double time on a relatively quiet evening Sunday shift is a good financial bonus I can’t pass up.

double time on a relatively quiet evening Sunday shift is a good financial bonus I can’t pass up.

out and eating healthy at an early age. Unfortunately, I also found a love for drinking. I’m thankful I found the first as it balanced the drinking to a degree. In saying that, I have some health issues now that perhaps I could have avoided with a healthier lifestyle. Others have overindulged their whole life. Like financial investment, it’s a lot harder to start at a later age and get results. Start early with a healthy lifestyle for immediate and longer-term benefits.

out and eating healthy at an early age. Unfortunately, I also found a love for drinking. I’m thankful I found the first as it balanced the drinking to a degree. In saying that, I have some health issues now that perhaps I could have avoided with a healthier lifestyle. Others have overindulged their whole life. Like financial investment, it’s a lot harder to start at a later age and get results. Start early with a healthy lifestyle for immediate and longer-term benefits.